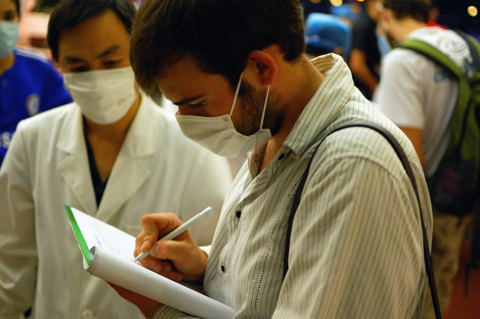

Yesterday afternoon we had gathered to watch some Beijing Opera, only to be told that the even was cancelled and that we must return to the dorms. Word slowly trickled down that there had been a few cases of H1N1 and that we were to be placed in quarantine. To save typing, below is the email I sent to the American embassy.

———- Forwarded message ———-

From: XXXX XXXX <xxxx>

Date: Wed, Aug 12, 2009 at 9:21 AM

Subject: In Beijing, have been quarantined

To: <embassy email>Good morning,

I and others of my summer session at Beijing Normal University were

moved into quarantine late last night/early this morning. (We were

finally moved to the quarantine hotel about 2 am.) Current location

appears to be the Yanxiang Hotel at A2 Jiangtai Road in the Chaoyang

District. We are told that we will be kept in quarantine for 5 days.I believe there are a few other Americans here, but only other name I

know at the moment is XXXX XXXX. (Most of the others I know are

Italian or Polish.) The [rumored] reason for the quarantine is that a

couple of students (Japanese, possibly Korean) from the No. 2

international students dormitory had contracted the H1N1 virus.Daily temperature tests will be taken at 0900 and 1600; it appears to

be taking them some time to reach everyone this morning as I only just

now hear voices in the hall. My temperature at arrival was normal.Regards,

XXXX