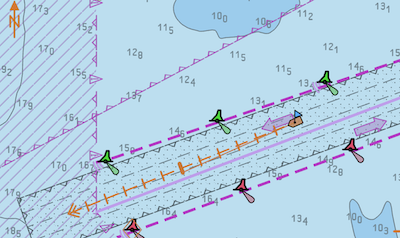

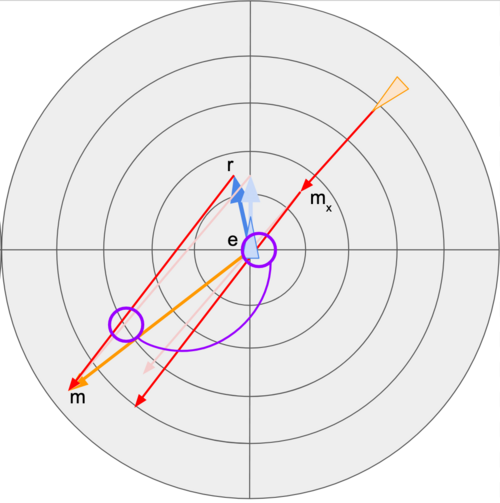

A few weeks back, in a discussion regarding the effectiveness of whether ’tis better to alter course for large cargo ships far in advance, or to proceed boldly ahead until the ColRegs take hold, I noted that relative motion diagrams are not all that commonly understood. Whilst most will not have occasion to whip out a maneuvering board and hand-draw a plot, understanding relative motion is still a key part of interpreting motion on a radar screen.

Here is my initial attempt at a short slide deck explaining the basics of relative motion and how to use that in evaluating crossing situations at sea:

https://docs.google.com/presentation/d/1-zx4r2QvN90tAFsvS3CJqxFO6LRbtmoMk3baTVetLgc/edit?usp=sharing